Usa Corporate Tax Rate 2025. According to the tax foundation, the corporate tax rate is 21% at the federal lecel, and most states also have a corporate income tax. For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

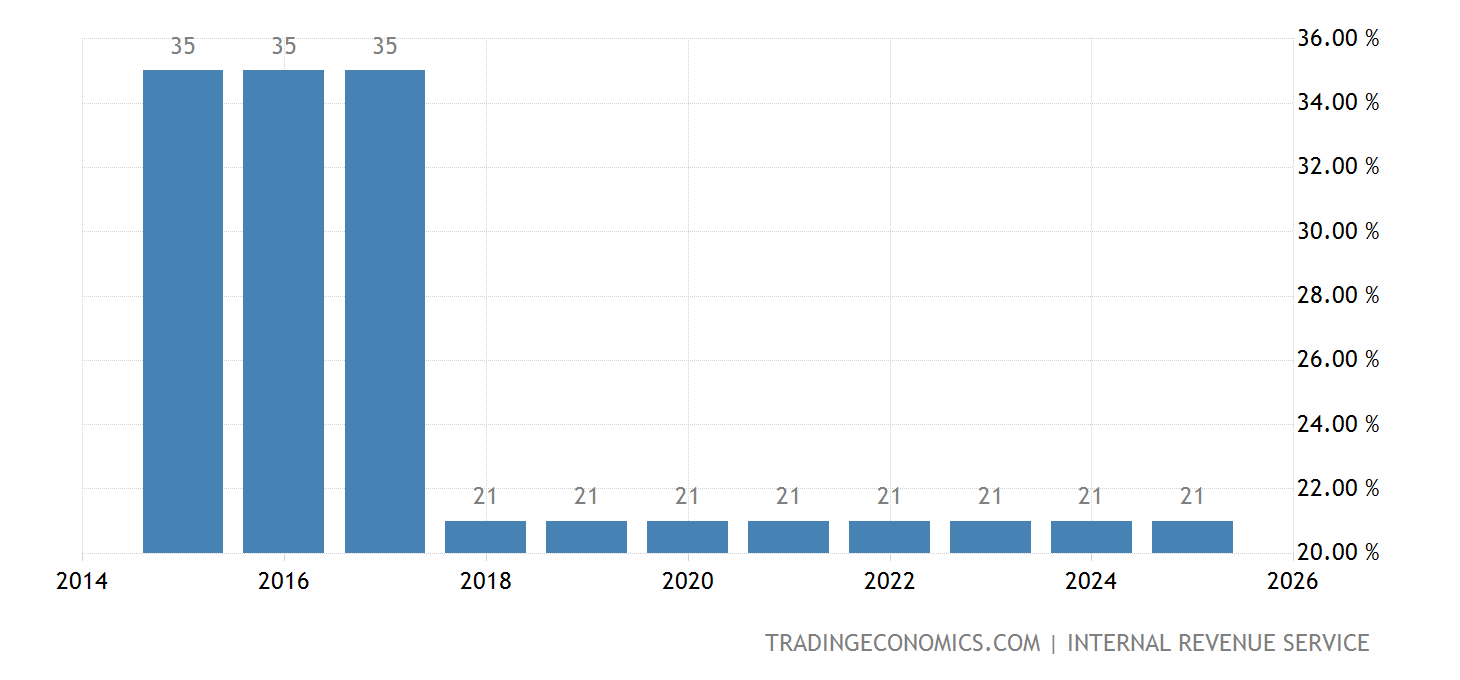

Increasing the corporate income tax rate; Prior to the 2017 tax cuts and jobs act of 2017, there were taxable income brackets, and the maximum tax rate.

2025 State Corporate Tax Rates & Brackets, Vice president kamala harris will push to increase the corporate tax rate to 28% from the current 21%, her campaign said monday, the first day of the democratic national.

United States Corporate Tax Rate 2025 Mamie Kayley, Taxing capital gains and dividends at ordinary income tax rates;

Corporate tax definition and meaning Market Business News, For tax years beginning after 2017, the tax cuts and jobs act (p.l.

Corporate Tax Rates For 2025 Image to u, 1, 2018, the corporate tax rate was changed from a tiered structure that staggered corporate tax rates based on company income to a flat rate of 21% for all.

United States Corporate Tax Rate 2025 Mamie Kayley, Historical federal corporate income tax rates and brackets, 1909 to 2025.

Tax rates for the 2025 year of assessment Just One Lap, Taxing capital gains and dividends at ordinary income tax rates;

美国 企业所得税税率 19092022 数据 20232024 预测, According to the irs, the average rate from.

2025 Tax Brackets And Standard Deduction Adore Mariska, 52 rows the current corporate tax rate (federal) is 21%.

Indiana Corporate Tax Rate 2025 Pammy Batsheva, Therefore, a corporation operating in the us could face a combined tax rate in excess of 21%.